It’s snowing outside in Golden, CO and I’m watching the Oracle of Omaha, Warren Buffet and his long-time investment partner, Charlie Munger, bestow their words of wisdom upon the eager throng of shareholders from a stadium in Omaha, NE.

It might not have been a rock concert as the header image implies, but I’m sure everyone watching Warren and Charlie drop knowledge bombs were just as excited!

Luckily for me, and for the first time in the nearly 40 years, Yahoo live streamed the entire event.

If you aren’t familiar with Berkshire Hathaway, you can think of it as an investment company that buys companies and holds them for life – or at least aspires to. It’s been run by Warren Buffet since the 1960’s, with Munger joining a few years later.

Warren and Charlie have an uncanny ability to make big decisions in an independent manner (without relying on consultants or an army of analysts for advice) – and then sticking to their guns for the long-term.

Their investing track record is unparalleled, despite avoiding hot market sectors like biotech, software and hardware technologies. They invest in businesses they understand and do remarkably well in the process.

Here’s a chart showing the growth of Berkshire Hathaway’s stock price and the S&P 500. Berkshire beat the stock market by such a grand margin that that the only way to make the chart sensible was to use a logarithmic scale, in which the vertical axis represents powers of 10:

The annual meeting is an epic show, starting at 8 am US Pacific Time and running well into the afternoon, with just a few breaks.

At 85 and 92 years old respectively, Warren and Charlie seem just as sharp, funny and wise as ever. As I listened to their remarks today, I’m making note of some of their comments that stood out.

But First: Vocations vs Careers

Before I dive into the other lessons I’ve learned, I want to point out something that reflects the reality of these two gentlemen doing what they have been doing for well over 50 years. It marks the difference between having a career vs. a vocation.

A career is something you do for a time, to earn money and perhaps learn, but ultimately give it up to “go live your life.”

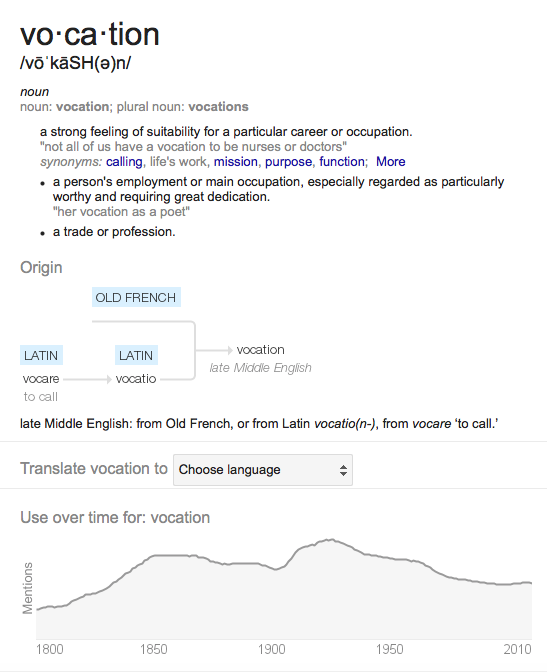

A vocation, on the other hand, is very different. It stems from the Latin “vocare” or “to call”. It is a calling to fulfill, not a task to get done.

A vocation is something you do because you are fascinated by it and it represents something you feel compelled and called to do. A vocation has no end-date, as the act of doing it, even it takes effort, somehow fills you up from the inside out.

I think we can all aspire to find our own vocation. That thing that has heart meaning and fascination for us. It is through this vocation that we can make a unique mark and feel fulfilled.

As I watch Warren and Charlie, I see what happens when you find your vocation, your calling. You are able to achieve mastery, captivate others (people generally acknowledge masters, regardless of extroversion) and continue to get better and improve, regardless of age.

In a future post, I’ll delve deeper into this idea of finding your vocation.

Now, onto the list of things that stood out for me from Warren Buffet and Charlie Buffet at the 2016 Berkshire Hathaway annual meeting:

Contents

Meritocracy

A question came up about why the Berkshire board of directors isn’t diverse.

Warren’s response focused on the importance of merit and hiring the right people for the right reasons, not based on the view of what others think they should do for the sake of inclusivity.

Warren and Charlie hire people to serve on the Berkshire board of directors who they believe will provide meaningful contributions to the board.

They don’t care about the gravitas of their name and aren’t in the business of paying board members hundreds of thousands of dollars (like other boards do). They focus on merit, not other factors.

I agree a lot with this approach. I believe in equal rights, but I disagree with biasing towards inclusivism at the expense of merit or as a way to appease outcry from an uninformed public.

Simplicity

At one point, when asked about the streamlined workings of his company, Warren said, “I’m sure we have a PowerPoint somewhere, but I wouldn’t know how to use it.”.

His operation is famously simple.

Warren quipped that even organizing the annual shareholder meeting involves everyone from the CFO to various staff members to put on. The event is legendary and well-run, and no dedicated “event planning” department is staffed up to handle it.

The event is a team effort and underscores the simple manner in which Warren and Charlie do things.

To me, this drives home the point that you can do big things without getting mired down in complicated structures and processes.

There is a beauty (and dare I say “power”?) in simplicity.

Trust

Warren and Charlie don’t micro-manage the CEOs of their holding companies, to the point where Warren emphatically stated that his managers are free to spend a billion dollars without asking him for permission if they feel like it the right thing to do.

If they buy a company and believe in the management, they should be there to support their businesses not micro-manage or create useless work for them.

This takes trust.

"Really outstanding managers are invaluable" – Warren Buffet

— Ravi Raman ???????? (@YogiRavi) April 30, 2016

The take-away for me is to think about how I can bring even more trust into my interactions – not just when it comes to my business and working with clients, but in my family interactions as well.

Humor

How do you keep a room full of investors laughing all day long? Simple, you play tapes of Warren Buffet and Charlie Munger bantering about!

During the annual meeting, about once every 10 minutes the crowd chuckled at something they said.

For example, when asked about the source for their humor, this exchange ensued:

Q: Where does your sense of humor come from?

A: It’s just the way I see the world. Let me ask Charlie, he’s funnier than I am… (crowd chuckles) – Warren

A: If you see the world accurately, you are bound to see the humor because it’s ridiculous. (…crowd erupts in laughter) – Charlie

I think we would all benefit from more humor in our days, especially in situations we consider “serious” (like business meetings).

Informed Opinions

Charlie Munger mentions that he either does the work needed to have an informed opinion, or he keeps quiet.

“I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.” — Charlie Munger (via Farnam Street)

What’s this means is that if you want to pontificate, you need to be educated! There is a reason why Warren is famous for his voracious reading.

Deal Making

Warren and Charlie pride themselves on doing due diligence themselves and locking a deal in with nothing more than a handshake or a simple contract. In fact, they commented that the longer negotiations take, the greater the chance of things getting messed up.

Most companies have armies of people tasked with deal-making and extended negotiations.

Berkshire makes do with most deals being done by Warren and Charlie primarily on their own. Warren remarked that they’ve made perhaps a dozen mistakes over the year using their approach, but none due to lack of due diligence.

The lesson here is that if you believe that negotiations and business dealings need to be complicated and lengthy, think again!

Happiness vs. Sugar

Berkshire is a large investor in Coca-Cola.

A question was posed if Warren and Charlie are OK with supporting a company that can be accused of promoting health disorders and obesity through their sugar-laden products.

Warren’s response raised a point that most ignore, that the value of drinking a Coke, and the happiness it creates, has benefits that cannot be overlooked. What’s the value in happiness? Does having the occasional Coke make you happy? Is that a good trade-off?

One must look at the negatives and positives of everything, instead of fixating on just one side of the argument or the other.

Warren also claimed to drink about 1/3 of his daily calories in Coke!

Staying Sharp

Watching two masterful business people at work makes me wonder how they manage to stay so sharp on the issues. The following quote from Warren emphasizes an underlying reality of business that no doubt motivates Warren and Charlie to stay on their toes and avoid complacency, even after so many decades of success.

"The nature of capitalism is that someone is always trying to take your business away from you." Warren Buffett

— Tren Griffin (@trengriffin) April 30, 2016

This brings me to my final takeaway, learning.

Learning

I set a goal to read at least 52 books in 2016 (check out my reading list on Goodreads). Learning is crucial to achieve mastery and stay relevant, let alone to avoid the trap of ignorance. The beautiful thing is, the learning process never ends, as Charlie Munger so eloquently states:

"Now that I'm 92 I have a lot of ignorance left to work on." Charlie Munger 2016. Stay humble. Stay hungry to learn.

— Tren Griffin (@trengriffin) April 30, 2016

0 Comments